RIDGEWOOD SAVINGS CELEBRATES 100 YEARS

BY SHANE MILER

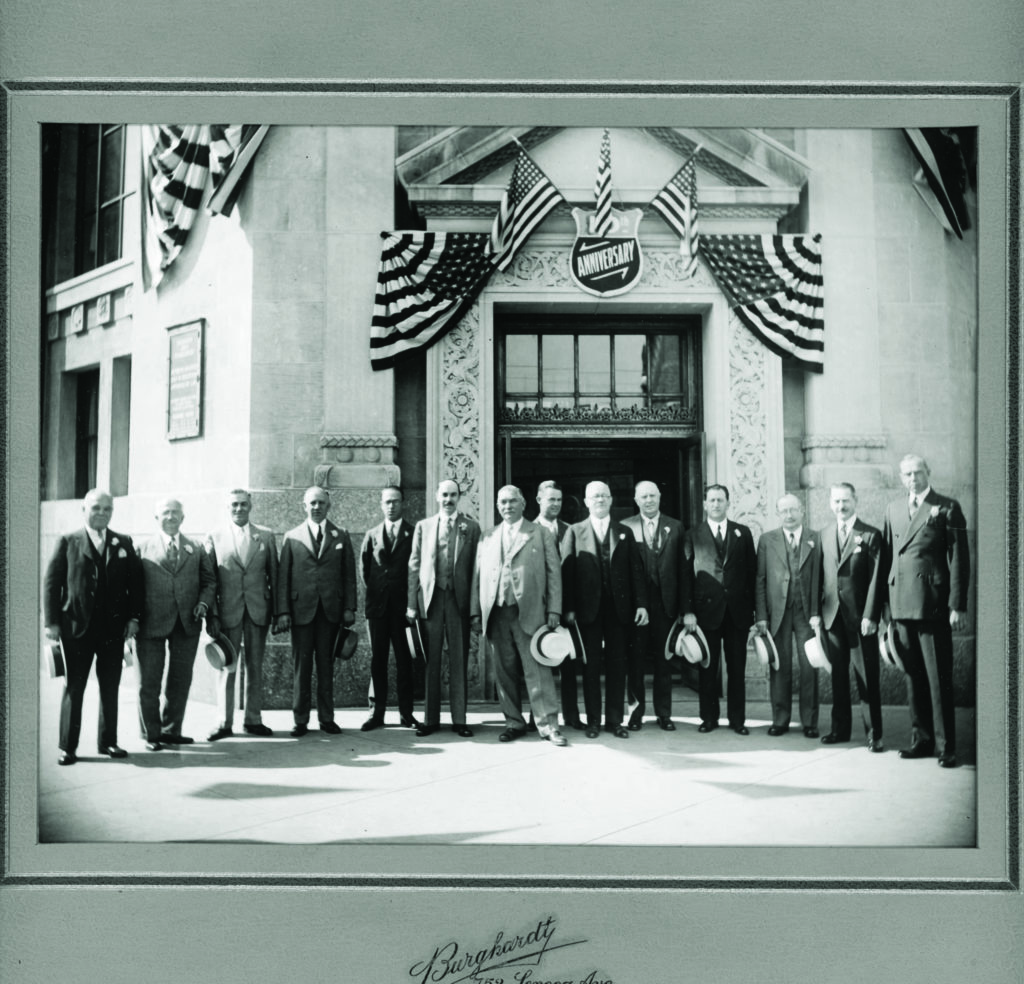

In 1920, 14 local business leaders, including an undertaker and butcher, formed a partnership with the goal of creating a bank in their local community. On June 18, 1921, then-mayor John Hylan presided over the opening ceremony for Ridgewood Savings Bank. On that first day of business, 519 customers deposited a total of $50,000.

As the bank prepares to celebrate its 100th anniversary later this month, Ridgewood Savings stands as the largest mutual savings bank in New York State with assets approaching $7 billion and 35 branches, ten of them in Queens.

“I’m really just a shepherd in this process,” current president and CEO Leonard Stekol told This Is Queensborough. “Somebody passed the baton to me, and I want to pass the baton to the next person to make sure we continue the legacy of Ridgewood Savings.

“So it’s an honor,” he added of being at the helm for such a momentous milestone, “but I’m really representing the forefathers, our board, and our employees. It is a point in time that represents the work of everyone else. The bank has been around for 100 years, it will be around for another 100 years.”

Stekol emigrated from Latvia in 1979 with his parents and younger sister, and the family eventually settled in Forest Hills. After he graduated from Queens College with a degree in accounting, he landed a job in the Audit Department at Ridgewood Savings Bank in 1992, where he has been ever since. He says his situation is not unusual.

“Our average employee has been here for decades, our customers have been with us for decades,” he said. “We service customers that are going on third or fourth generations.”

Just under four years ago, Stekol was appointed president and CEO. He said as he moved up the corporate ladder, he was able to continue his education thanks to Ridgewood Savings.

“We have very strong incentives and a commitment to education, so I was fortunate enough to get my master’s degree,” he said. “While I was working at the bank I was also taking advantage of these opportunities that to this day are still offered to all of our employees, regardless of rank and title.”

That commitment to education extends to the bank’s customers, particularly in the area of financial literacy. Ridgewood Financial Academy offers free online tutorials on topics like owning a home, running a small business, and the foundations of a sound financial situation. Many of the tutorials are under ten minutes.

“What we’ve found is that the younger generation, while very highly educated, don’t understand some of the basics,” Stekol said. “That includes things like how to apply for a loan, how to build up your credit score, and how to look for a mortgage. It’s even things like how does a checking account work.”

Individual branch managers also work with local students, often visiting classrooms to conduct financial literacy classes. For example, bank vice president Lou Ann Mannino recently hosted a class via Zoom for students at The Young Women’s Leadership School of Astoria in conjunction with the nonprofit group Lessons for My Daughter. The bank also helps elementary school kids open their first bank account, starting them off with $10 in seed money.

Stekol said it’s all part of the bank’s efforts to create relationships in the community in a variety of ways, which includes hosting community events like Girl Scout cookie sales, car washes, and summer concerts at local branches.

He said that strong presence in local communities was never more important than during the pandemic, which included providing nearly $30 million in federal funding to over 4,000 local businesses through the Paycheck Protection Program.

“I’m really proud of how the bank stepped up with so many different initiatives to give back to the community,” Stekol said. “Our efforts were always there, but we increased them.”

Building those relationships also means embracing new ways of banking made possible through technology, including a highly rated banking app. Customers can also take advantage of the experts at Ridgewood Financial Services to guide them in retirement planning or investing in the stock market.

“Those are services in addition to the normal things that you would find in a bank,” Stekol said. “We try to do our best to form relationships and service our customers with all of their different financial needs.”

But while some people feel perfectly comfortable banking online, Stekol says the bank has not abandoned the services historically associated with traditional banking.

“We offer state-of-the-art digital channels, but at the same time if you want to pick up a phone and call us, that’s wonderful as well,” he said. “We don’t push our customers to bank with us in any particular way.”

If you do pick up a phone and call Ridgewood Savings Bank, it’s likely you will be talking to someone in the bank’s call center, which for the past six years has been staffed 24/7 in the bank’s Main Branch, an iconic building at Forest and Myrtle avenues in Ridgewood that was built in 1921 on the site of a former saloon.

“It’s the hand-holding and compassion that separates us from other banks,” Stekol said of the importance of the call center. “Some people might need a little more help, and that’s what we bring to the table.”

Ridgewood Savings Bank’s commitment to its customers has not gone unrecognized by the banking industry. In 2020, the bank was named the second-highest-performing bank in New York State in an independent customer survey conducted by Forbes magazine. In a second customer survey, the bank landed in the top five in the New York market in the 2020 Banking Choice Awards.

“All of our passion, persistence, and efforts have been recognized, and that’s coming from our customers. We didn’t apply for those awards,” Stekol said. “Many banks offer similar services, but the entire essence of a community bank is giving back. It makes a difference in ordinary lives.”

To celebrate the bank’s centennial, Ridgewood Savings is hosting a number of different events and promotions, but one that Stekol is particularly proud of is the Random Acts of Kindness program. Bank customers are chosen at random in various branches to receive a $100 gift card, which Stekol hopes they will use to exemplify the bank’s motto of “multiplying the good.”

“All we tell them is ‘pay it forward,’” he said. “Take this and do something nice for a complete stranger.”